Blog Details

As an experienced international freight forwarder, I frequently encounter customers' confusion when choosing between trade terms, especially between EXW (Ex Works) and FOB (Free On Board). Understanding the differences between these terms is crucial for optimizing logistics costs and managing risks. Here's my comparative analysis of EXW and FOB from the perspective of a freight forwarder.

Definition of Trade Terms

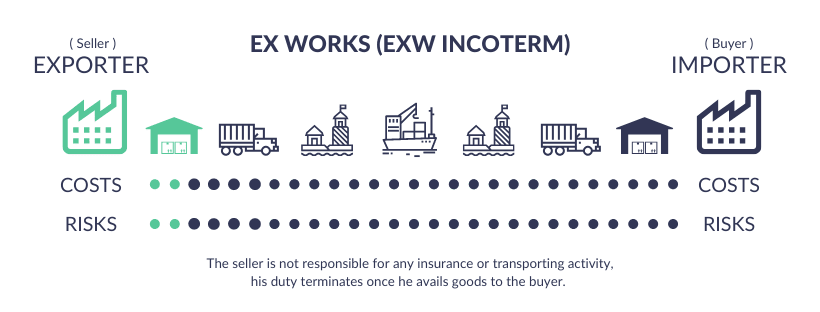

EXW (Ex Works): This is the most basic form of transaction. Under EXW, the seller only needs to make the goods available at their premises (like factory, warehouse, etc.). From that point, all transportation costs and risks are transferred to the buyer.

?

?

FOB (Free On Board): This is a more common international trade term. Under FOB, the seller is responsible for delivering the goods to a specified loading port and covering all local costs, including export customs clearance. Once the goods are over the ship's rail, the risks and costs are transferred to the buyer.

?

Transfer of Costs and Risks

EXW: The buyer assumes all transportation costs and risks right from the seller's factory, including loading, transportation to the port, and export customs clearance.

FOB: The buyer begins to bear all the transportation risks and costs from the moment the goods pass the ship's rail at the loading port.

Role of the Freight Forwarder

Under EXW, as the buyer's freight forwarder, we typically handle the complete logistics chain from the seller's factory to the final destination, including inland transportation, loading/unloading, export customs clearance, etc.

Under FOB, as the buyer's agent, we are mainly responsible for the logistics segment starting from the shipping port, including sea freight, customs clearance at the destination port, and subsequent delivery.

Impact on the Buyer

EXW: The buyer needs stronger logistics control and resources to manage the entire transportation process. Suitable for buyers who want more control over the logistics process.

FOB: More convenient for buyers who do not possess comprehensive logistics management capabilities. The seller takes care of all work up to the shipping port, and the buyer assumes responsibility from sea freight onwards.

Which Is Better?

Choosing between EXW and FOB depends on the needs, resources, and risk-bearing capabilities of both parties. EXW might be more suitable if the buyer wants complete control over the logistics process; FOB might be better if the buyer wants to reduce management burdens and risks.

In conclusion, as a freight forwarder, we advise our clients to consider their logistics capabilities and risk management strategies when choosing trade terms. Understanding the fundamental differences between these terms can help businesses make the best logistics decisions, optimize cost-effectiveness, and reduce potential risks.

?

About Company

QIFLY offers various logistics solutions for Chinese exports, including air,sea freight and express. We promote trade between China and the world, contributing to the development of your business.

Blog Details

As a professional freight forwarder, I often encounter clients' confusion when choosing trade terms, especially between DDP (Delivered Duty Paid) and DDU (Delivered Duty Unpaid). Understanding the difference between these two terms is vital for ensuring smooth logistics and avoiding unexpected costs. Here's a detailed comparison of DDP and DDU from the perspective of a freight forwarder.

Definition of Trade Terms

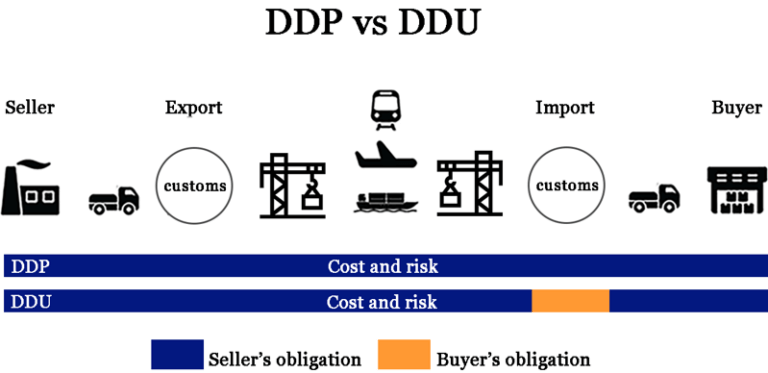

DDP (Delivered Duty Paid): Under DDP, the seller assumes almost all responsibilities and risks for transporting the goods to the buyer's specified location, including transportation costs, insurance, and all import duties and taxes.

DDU (Delivered Duty Unpaid): Under DDU, the seller is responsible for transporting the goods to the destination, but not for paying any import duties and other taxes at the destination.

?

Responsibilities and Risks

DDP: The seller bears the highest level of responsibility and risk, including all costs and risks during transportation, as well as the destination country's duties and taxes.

DDU: The seller's responsibility ends with safely transporting the goods to the specified destination, not including payment of import duties and taxes. The buyer needs to take care of this part of the costs and the related customs clearance procedures.

Role of the Freight Forwarder

Under DDP, as the seller's agent, we typically handle the complete logistics chain from start to finish, including customs clearance and paying duties and taxes.

Under DDU, as the seller's agent, our responsibility generally ends once the goods arrive at the destination country's port or airport. The buyer or their agent needs to handle the destination's customs clearance and tax payments.

Impact on Buyers and Sellers

DDP: Suitable for buyers who want to minimize dealing with customs and tax issues in the destination country. Buyers almost don't have to worry about any additional costs when receiving the goods.

DDU: Suitable for buyers willing to handle import processes in their country, especially those who have a clear understanding of local duties and taxes.

How?to Choose?

Choosing between DDP and DDU depends on the parties' desire for control over costs, risks, and customs processes. DDP is more suitable for buyers wanting to simplify operations and avoid the complexity of customs clearance in the destination country. DDU is better for buyers willing to undertake the responsibilities and costs associated with the importing country.

In summary, understanding the differences between DDP and DDU is crucial for international trading parties to formulate suitable logistics and customs strategies. As a freight forwarder, our task is to help clients understand these trade terms and provide corresponding logistics solutions to ensure smooth transactions while minimizing risks and costs.

?

About Company

QIFLY offers various logistics solutions for Chinese exports, including air,sea freight and express. We promote trade between China and the world, contributing to the development of your business.

Blog Details

When it comes to international trade, understanding the terms of sale is crucial for the smooth execution of transactions and shipments. Among the myriad of Incoterms, CFR (Cost and Freight) and CIF (Cost, Insurance, and Freight) are two that often confuse. Both relate to the shipping terms used in the sale of goods when crossing international waters, yet they have distinct differences that can significantly impact the responsibilities and risks of exporters and importers. In this blog, we'll demystify these terms and help you understand which one might be best suited for your trade needs.

What is CFR?

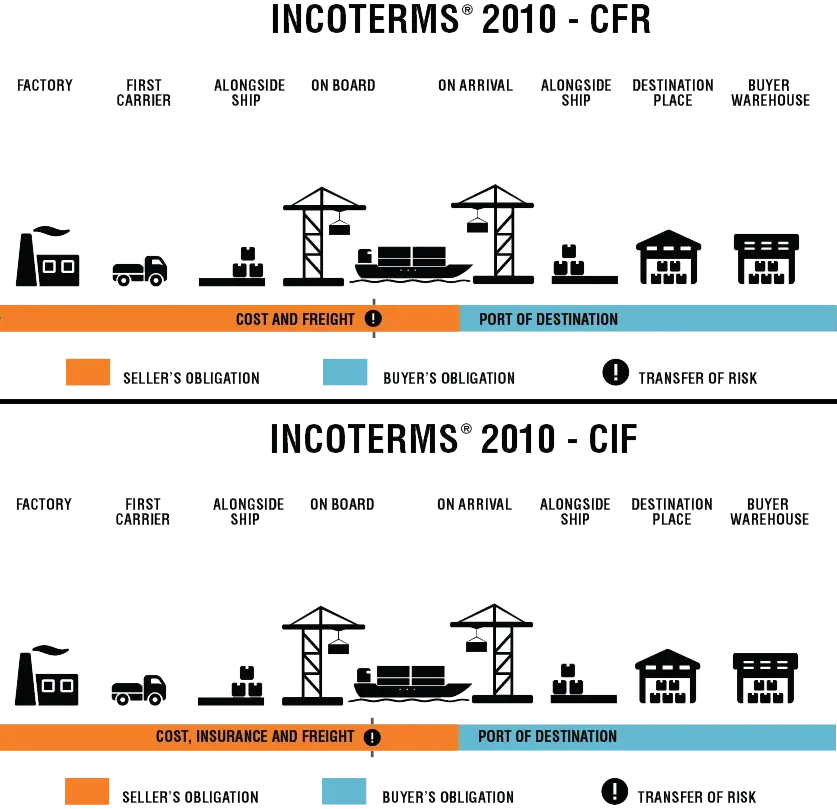

CFR, or Cost and Freight, is an Incoterm where the seller is responsible for the cost of transporting goods to the destination port. Under CFR, the seller must arrange and pay for the transportation of the goods until they reach the port of destination chosen by the buyer. Once the goods have been loaded onto the shipping vessel, the risk of loss or damage to the goods transfers from the seller to the buyer. Therefore, it's the buyer's responsibility to insure the goods from the point of departure.

?

?

Key Points for CFR:

Seller pays for transportation to the destination port.

Risk transfers to the buyer once goods are on board the vessel.

Insurance during transit is the buyer's responsibility.

What is CIF?

CIF, or Cost, Insurance, and Freight, is one step further than CFR. Not only does the seller cover the costs and freight to get the goods to the destination port, but they also pay for the insurance during the sea transit. The transfer of risk is the same as CFR—the seller’s risk ends when the goods are on board the vessel. However, with CIF, the seller has to procure marine insurance against the buyer’s risk of loss or damage to the goods during the carriage.

Key Points for CIF:

The seller pays for transportation and insurance to the destination port.

Risk transfers to the buyer once goods are on board the vessel, but the seller procures insurance.

The seller's responsibility includes insurance coverage for the goods until the destination port.

Which One Should You Choose?

Choosing between CFR and CIF often depends on the agreement between buyer and seller and who wants to take on the insurance responsibility. Here's what to consider:

When to Choose CFR:

If the buyer can obtain insurance at a more competitive rate.

When the buyer has better control over the insurance process.

If the buyer wishes to manage the risk from the port of origin.

When to Choose CIF:

If the seller has better access to insurance options.

When the seller can bundle insurance with freight for better rates.

For buyers who prefer an all-inclusive price and would rather not deal with insurance separately.

Implications of CFR and CIF

Understanding the implications of CFR and CIF is paramount, especially when negotiating contracts. Here are some further considerations:

Insurance Coverage: Under CIF, sellers must obtain insurance only for minimum coverage. Buyers may need additional coverage for their goods.

Cost Control: CFR can potentially offer more cost control to the buyer since they are responsible for the freight and insurance arrangements.

Convenience: CIF is often seen as more convenient for the buyer since the seller arranges most of the shipping logistics.

Conclusion

In conclusion, while CFR and CIF may appear similar at first glance, the differences, particularly regarding insurance, are significant. Sellers and buyers must carefully consider these terms and choose the one that aligns with their needs and provides the most strategic advantage. As with all international trade dealings, it's recommended to consult with a legal or trade expert before finalizing any agreements. Whether you opt for CFR or CIF, a clear understanding of the terms will help you navigate the complexities of global trade with confidence.

?

About Company

QIFLY offers various logistics solutions for Chinese exports, including air,sea freight and express. We promote trade between China and the world, contributing to the development of your business.